Offshore market: a study that overturns certainties

A new study by Nordic researchers highlights the lack of reliable data on the size of the offshore market. The findings, published in the journal PLOS ONE, cast a shadow over political decisions and public discourse, which until now have been largely based on uncertain figures.

When the figures become blurred

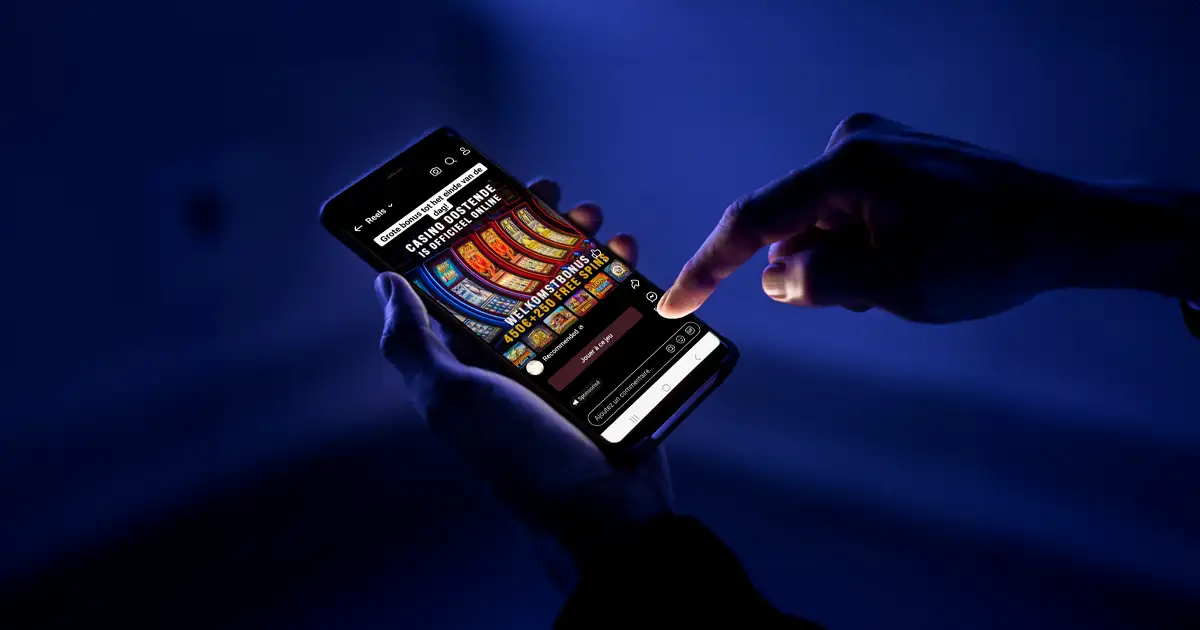

For years, public authorities, regulatory bodies and industry players have debated the expansion of offshore gambling, often presented as a threat to legal systems and player protection. But what exactly is the extent and evolution of this unauthorised market? According to the study, the answer remains uncertain.

The researchers reviewed 32 reports published between 2010 and 2024 in several Nordic countries, including Sweden, Finland, Norway and Denmark. They immediately note that the methods used to measure this market vary considerably from one study to another. Definitions of what constitutes an offshore operator differ, making comparisons almost impossible. Worse still, the majority of estimates used today are based on data from a single private supplier (H2 Gambling Capital) whose calculation methods are not transparent. As a result, even regulators sometimes seem unaware of the assumptions and metrics underlying these data.

Faced with these findings, Professor Håkan Wall, a researcher at Karolinska Institutet and co-author of the study, issues a stern warning: when the methods are obscure, the figures can do more harm than good. This uncertainty makes it difficult, if not impossible, to accurately assess the impact of regulatory policies or legislative changes on actual gambling activity.

This methodological criticism calls into question a whole series of reports, particularly those commissioned by industry itself. The authors of the review point out that studies funded by economic players tend to have higher offshore market shares than purely academic work. This suggests that some conclusions may be more strategic storytelling tools than objective descriptions of a phenomenon.

What are the implications for regulators?

Data on offshore gambling is often cited by governments when assessing the effectiveness of their regulatory policies. If these figures are unstable or biased, the resulting decisions could be based on supposition rather than tangible evidence.

In some Nordic countries, for example, official estimates suggest that up to 15-20% of the market could be unlicensed. Other analyses put forward very different figures, depending on the sources and methodologies used. This spectacular variation leads researchers to fear that the figures do not really reflect gamers’ behaviour, but rather the design choices made in the studies themselves.

Towards better measurement of the offshore market

One of the strengths of the study is its proposed solutions. Rather than relying on a single source or divergent methodologies, the researchers recommend a multi-method approach. This includes the combined use of data from surveys, anonymised bank transactions, statistics on requests for help with gambling problems and indicators linked to user behaviour.

Another key aspect is the call for clear, shared definitions of what an offshore operator really is. Without a consensus on this point, any international or intertemporal comparison remains hazardous. The study also stresses the need to separate political and commercial interests from the very design of scientific research, to avoid biased conclusions artificially shaping market perceptions.

If these avenues are followed, they could improve not only the quality of the data, but also the confidence of stakeholders in the statistical measures produced.