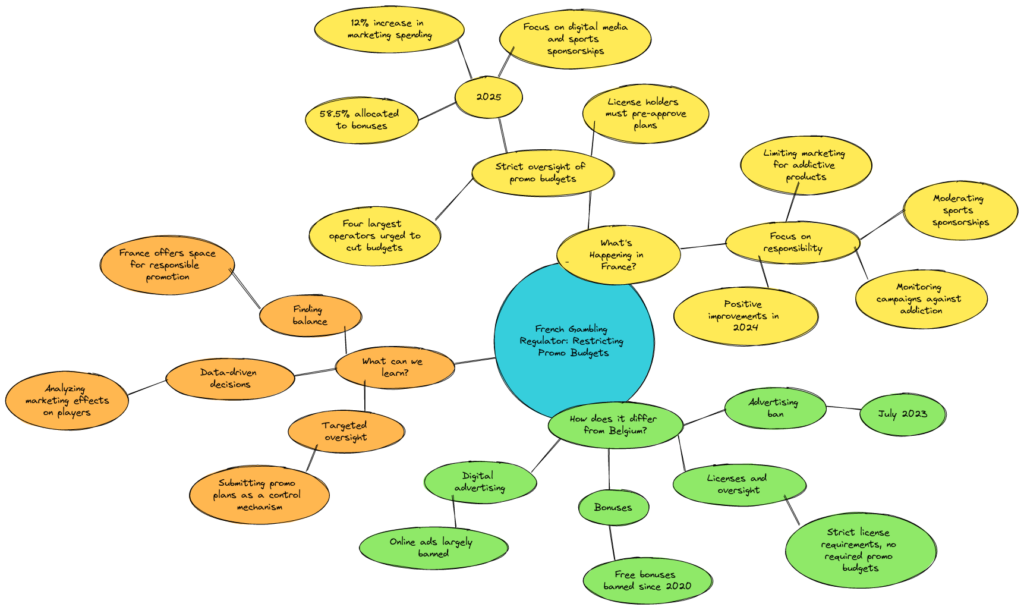

French gambling regulator wants to limit promotional budgets, how is it going in Belgium?

The French gambling regulator, l’Autorité Nationale des Jeux (ANJ), has called on major gambling operators to review their promotional budgets for 2025. The reason? An 11% increase in total promotional expenditure is predicted, which could increase the risk of gambling addiction and reaching minors.

But how does this approach differ from the Belgian situation, and what can we learn from it?

What is happening in France?

Strict supervision of promotional budgets

In France, all licensees must submit their promotional plans to the ANJ for prior approval. For 2025, this amounts to a total promotional expenditure of €695 million, including marketing and bonuses. This shows:

- 58.5% of the budget goes to bonuses for players.

- Marketing expenditure increases by 12%, with digital media and sports sponsorship taking up a large share.

The ANJ has explicitly asked the four largest gambling operators – which together represent 85% of the promotional budget – to reduce their expenditure. This should help limit the impact on vulnerable groups, such as minors and problem gamblers.

Focus on responsibility

The ANJ has set additional requirements:

- Sports sponsorship must be moderated to prevent overexposure.

- Marketing aimed at gambling products with a high risk of addiction, such as fast poker tournaments, must be limited.

- Operators must better monitor campaigns to combat gambling addiction and excessive gambling behaviour.

The regulator also complimented operators for their improvements in 2024, such as reducing marketing expenditure and avoiding child-oriented influencers.

How does this differ from Belgium?

Belgium also has strict rules on gambling advertising, but the approach differs on a number of important points:

Advertising ban

In Belgium, almost all gambling advertising has been banned since July 2023, including sports sponsorship. This is much more drastic than the French measure, where sponsorship and advertising are still permitted, albeit under strict conditions.

Licenses and supervision

As in France, Belgian gambling operators must adhere to strict licensing requirements. The Gaming Commission (KSC) supervises, but the French model, in which operators submit annual budgets for approval, is not applied in Belgium.

Bonuses

Free bonuses have been banned in Belgium since 2020. In France, bonuses continue to take up a large share of promotional budgets (58.5%). This difference highlights how strict Belgian regulations are compared to France.

Digital advertising

In Belgium, online advertising is also largely banned, while France sees digital media taking up a growing share (45%) of marketing expenditure.

What can we learn?

The French approach offers some interesting insights:

- Finding a balance: While Belgium almost completely bans gambling advertising, France leaves room for responsible promotion. This could be more effective in maintaining a regulated gambling offer and preventing a shift to illegal operators.

- Targeted supervision: Mandatory submission of promotional plans as in France could also be a valuable addition in Belgium. This offers more flexible control without complete bans.

- Data-driven decisions: France monitors marketing expenditure and analyses its effect on players. Belgium could consider this approach to better assess whether stricter restrictions are needed.

Although Belgium and France both strive for responsible gambling, they take very different approaches. While Belgium virtually bans gambling advertising, France regulates more strictly but still gives operators freedom. Both systems have their advantages, but the French balance between regulation and freedom offers an interesting case for Belgium to consider.